Dollar may start to rebound amid the rest of the central banks turning dovish, short EUR/USD?

Global rates’ differential to determine capital flows toward end of 2018

The current focus for FX Traders around the world should be on how global central banks aim to slow the pace of tightening, instead of projecting how quick the Fed is going to raise the interest rates and whether there will be two or three more. Having more dovish central banks around the world could be the main reason behind a potential dollar rally, more than the impact from the Fed itself.

Last week, two more central bank followed the tone of what ECB offered lately, as both RBNZ and Bank of England pushed back their rates hike expectation by raising the uncertainties of inflation outlook. NZD and GBP tumbled against dollar after the policy meetings. RBNZ kept official cash rate at record-low of 1.75%, and Governor Adrian Orr said, “the direction of our next move is equally balanced, up or down”. Some traders even view this as “a door opening to cut the interest rate” as its next move. At the same time, central bank pushed back its forecast for inflation goal to be reached by 4Q 2020 from 3Q 2020. Markets aren’t pricing in a hike until 3Q 2019 as it appears not too late in our opinion. Regarding policy changes, we still view the next NZ’s OCR move to be a rate hike, that is if a broadening in inflationary pressures continue to materialize, and current global market wobbles not to take a turn for the worse.

For Bank of England, it left interest rates unchanged and signalled it was in no hurry to tighten policy further. Investors in UK money markets priced out the possibility of a rate increase this year after the central bank said that only limited tightening was needed in the coming years. The market-implied probability of a 25 basis-point hike, which was fully factored in for November before the BOE decision, has declined to 85% following the announcement. What is very clear is that the Bank of England has offered a reassurance that it is still data dependent, not model dependent as feared in February. Having said that, whether pound rebounds or not in coming months will be fully dependent on incoming data, especially on the inflationary related ones.

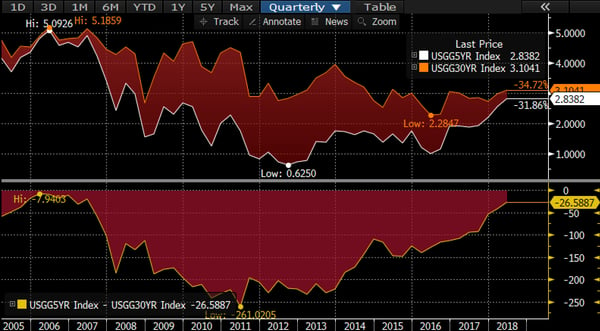

Even in United States, bond traders have already reached their verdict. The yield spread between 5- and 30-year Treasuries narrowed last week to as low as 26.2 basis points, the lowest since August 2007. The prospect of an inverted curve, which has presaged past recessions, is as strong as ever, predicting it could happen later this year or in 2019 if the Fed keeps up its pace of rate hikes.

US 5/30 year Treasuries’’ yield spread

Source: Bloomberg

However, standing in a global perspective and macro view, Fed’s policy is set to being more hawkish than most of the other major central banks. Such outcome will continue to widen the yield spread between the US and the rest. A chart below shows US and Germany 10-year yield gap has widened to 241 bps, the highest in the past five years, implying that dollar has plenty room to appreciate against the euro in coming months. The US economy has a lot of potential to continue to grow though that will require Fed playing its cards carefully. Oil prices rise looks to be sticky above $70 per barrel but this will stimulate US production and the increased supply will prevent it from escalating towards $100/barrel. However, it’s enough for the Fed to hike the rates by at least two times towards the end of 2018.

US and Germany 10-year yield gap

Source: Bloomberg

Our Picks

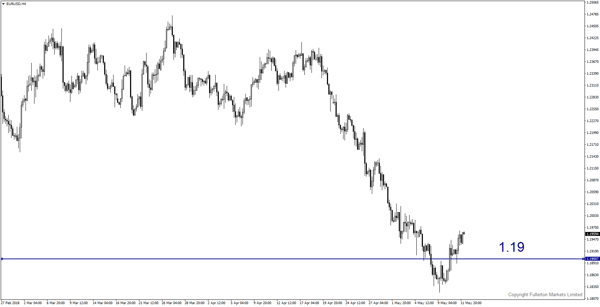

EUR/USD – Slightly bearish.

This pair may drop towards 1.19 this week again, mainly because of a steady dollar perspective.

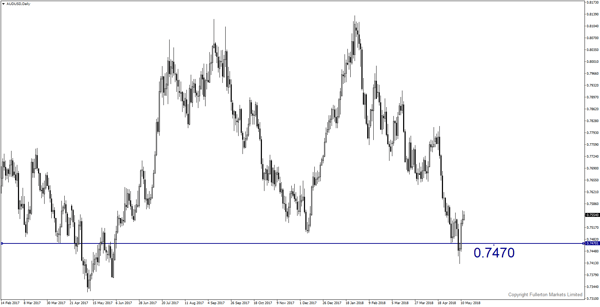

AUD/USD – Slightly bearish.

If China’s economic data this week stays below forecast, AUD/USD may drop towards 0.7470.

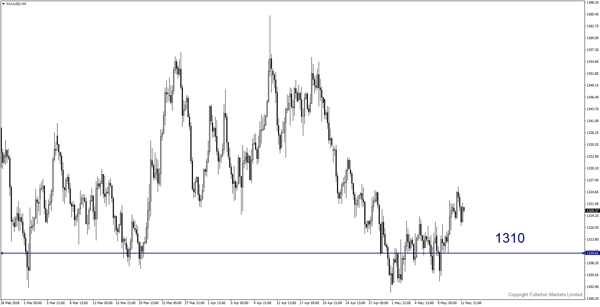

XAU/USD (Gold) – Slightly bearish.

We expect price to drop towards 1310 this week.

Fullerton Markets Research Team

Your Committed Trading Partner