Regional stocks, including Thai equities, may find it hard to have any meaningful rebounds in price.

Uncertainties on US-China trade tension not only weighs on risk assets and encouraged flows into safe-havens, it is also putting Fed’s policy into a difficult position.

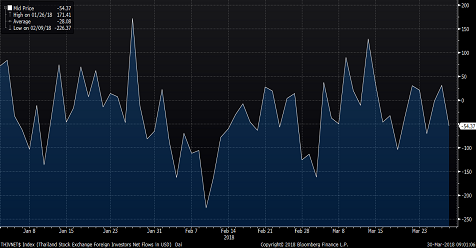

According to data, Thailand equities outflows are the third largest among major Asia markets. It reached USD 95 million last week and hit USD 1.8 billion in 1Q this year. However, its bond inflows are the third biggest among the major regional markets. These set of flows data clearly illustrate that the nation’s fixed-incomed markets are more attractive than their stocks market for now.

Thailand Stocks Market Flows, Source: Bloomberg

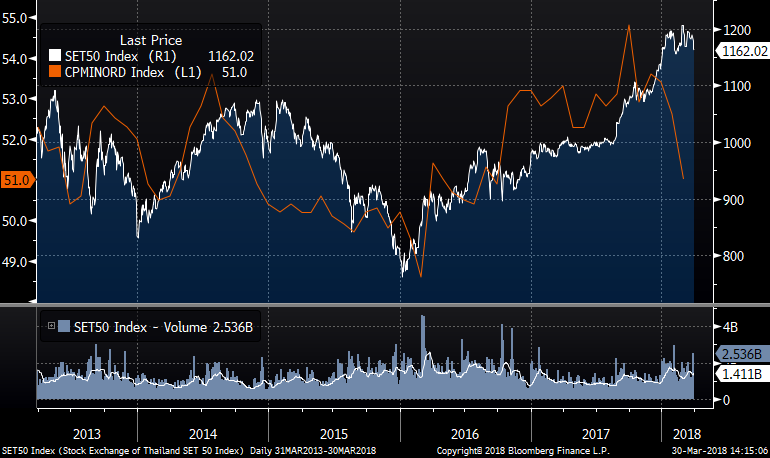

Another key reason that pressured the Thailand’s stocks lower is weaker Chinese demand as China is Thailand biggest trade partner now. Thailand domestic demand have softened at this moment due to the waning consumer confidence and soft inflation. Furthermore, its growth is largely dependent on the Chinese domestic demand, which is perfectly reflected in the Thailand’s stocks market. Thailand’s stock index has been moving in tandem with the China manufacturing PMI new order index for the past five years. The sharp decline in Chinese new order index may well explains the recent drops in Thai stocks.

Thailand Stocks Index (White) and China Manufacturing PMI New Order Index (Orange), Source: Bloomberg

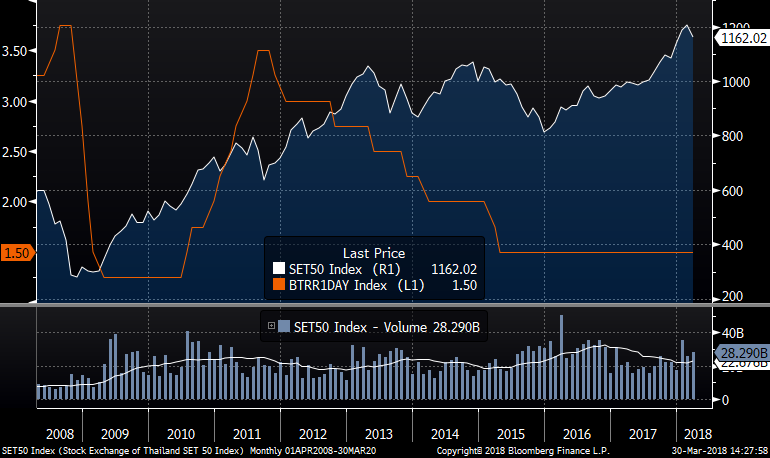

As to regard to the domestic monetary policies’ impact on Thai stocks, it could underperform when compared to bond markets. The Fed may be back to its gradual rate hike path as US inflation failed to accelerate, and uncertainties arose after the US-China trade tension. A gradual Fed buys time for Bank of Thailand to hold interest rate, and such an outcome will continue to encourage inflows into their bond markets instead of stocks. Besides that, managers may further adjust their portfolios from stocks to bonds. The chart below shows that the rebound in Thai stock market needs a higher benchmark interest rates. (NOTE: gains in stocks in the past two years are mainly due to the synchronized rallies in global equities, less on domestic conditions)

Thailand Stock Index (White) and Bank of Thailand Benchmark Rates (Orange), Source: Bloomberg

Fullerton Markets Research Team

Your Committed Trading Partner