Stocks Pick of The Week - Stocks Momentum Largely Improved After Evidences Show Fed Turns into Dovish

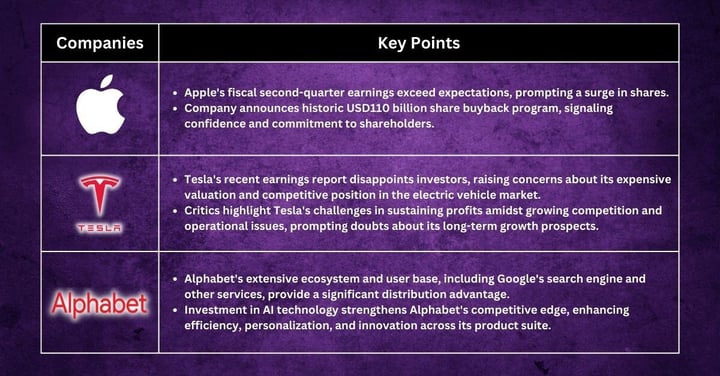

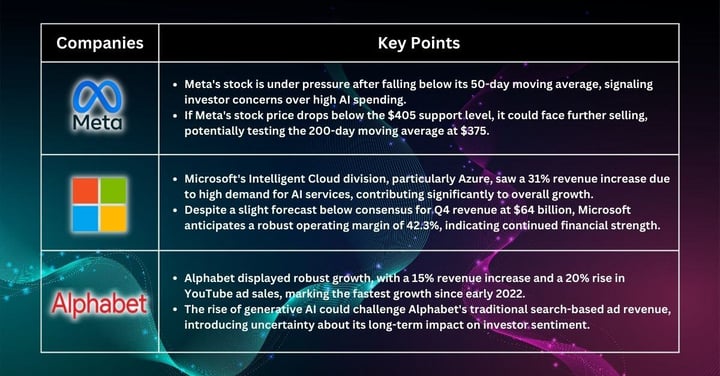

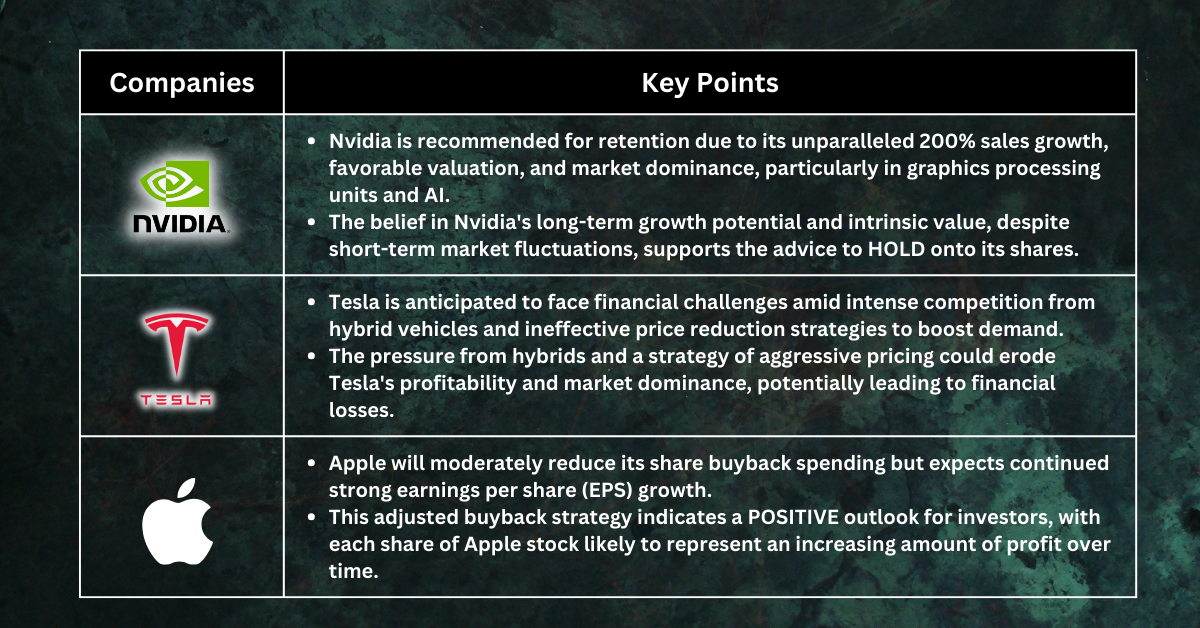

Investors have been more optimistic lately after the Fed indicated the next move is unlikely to be a hike, pointing to a cap on interest rates that could be bullish for equities. A strong earnings...