The uncertainties are high as tariffs arrive, short AUD/USD?

Markets will be watching Powell to offer any possible clue on Fed’s monetary policy during Jackson Hole

With Fed Chairman Jerome Powell set to deliver a Friday morning speech, investors will be looking for clarity on a host of issues ranging from; the likely path of interest rates and balance sheet policy, to Powell’s take on emerging-market turmoil, and possible Fed’s policy adjustment amid US-China trade tension.

- The September hike is almost certain, but December one is still uncertain.

The Fed is widely expected to hike rates for a third time this year in September, but a fourth move in December is less certain as of now. It’s also unclear how far officials will go before pausing in their gradual upward march. Powell added haze to the picture in July when he told US lawmakers that gradual rate hikes were appropriate for now.

We do not expect Fed officials to jawbone interest-rate expectations for the next few meetings at this point in time. Officials are firmly committed to a September rate increase, and while they are leaning toward a December hike, they are likely satisfied with market probabilities retaining some optionality.

Fed funds futures are pricing in a December rate hike at just over 60%. FOMC participants will wait to see how the economy and labour market perform in the second half of the year as escalating trade tensions offset at least some of the economic gains expected from tax reforms. Fed officials may leave year-end rate hike an open question until after the midterm elections in early November.

- Market may also watch Fed’s approach amid US-China trade talk

Late last week, hopes of an easing Sino-US trade tension ignited a brief reprieve, but investors should be prepared for little to come from a Chinese delegation which is led by lower ranks of the authorities. When Mr Trump’s second round of tariffs takes effect on 23 August, only 10% of China’s exports to the US will be affected. However, if the Trump administration follows through on its most recent threat against an additional $200bn worth of Chinese exports, this would bring the total value of affected goods to $250bn. This is close to half of China’s exports to its largest trading partner which will be taxed at 25%. Whether Fed would put this as a concern on its monetary policy, it will certainly affect the US dollar.

China’s central bank has been more dovish, allowing a flood of liquidity to drive money market rates to multiyear lows. If PBOC has such concerns, how about the Fed?

Our Picks

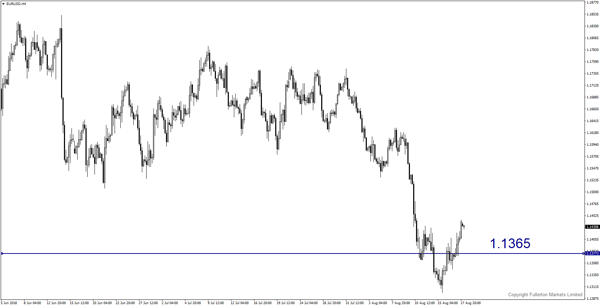

EUR/USD – Slightly bearish.

This pair may drop towards 1.1365 as Fed’s Powell may reiterate its tightening stance at Jackson Hole.

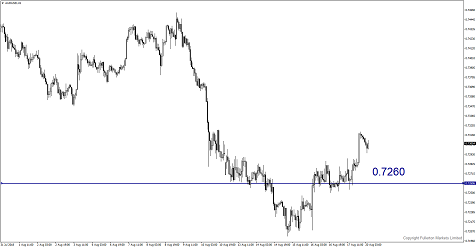

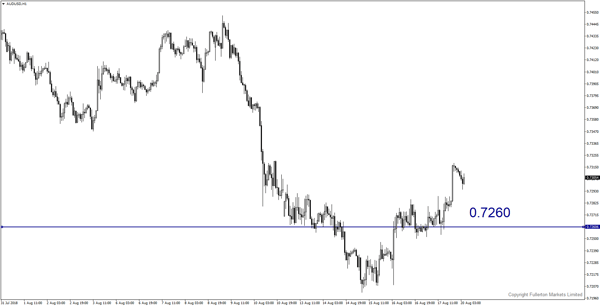

AUD/USD – Slightly bearish.

US-China trade negotiation this week may pressure this pair towards 0.7260.

XAU/USD (Gold) – Slightly bearish.

We expect price to fall towards 1171 this week.

Fullerton Markets Research Team

Your Committed Trading Partner