When Brexit and China’s growth outlook remain uncertain, nothing could be safer than shorting USD/JPY.

Whether there will be a Brexit deal, development in these two days is crucial

UK PM Boris Johnson will make another attempt to win parliament’s backing for his Brexit deal amid growing confidence that he can overcome a series of setbacks over the weekend and now has the backing of the 320 MPs needed for victory.

Mr Johnson insisted he can still deliver Brexit on 31 October despite losing a crucial vote on Saturday and being forced to write to the EU seeking a three-month delay to the Article 50 exit process. Dominic Raab, the UK’s foreign secretary, said Boris appeared to have the numbers to get it through and suggested he is on course to win by five votes, but the result is on a knife-edge. The UK prime minister has a two-pronged strategy for making progress this week: either winning a new “meaningful vote” on Monday or by securing a majority when legislation implementing the deal is put to a vote on Tuesday.

According to some analysis, there could be a majority of five for the Brexit deal. Some 320 MPs appear set to back Mr Johnson’s deal, with 315 opposed. Johnson’s Commons defeat during the weekend meant MPs have delayed approval of his deal until after the Withdrawal Agreement bill has been agreed by parliament. Therefore, Johnson could not meet the deadline set down under the so-called Benn act, to win Commons support for his deal.

Johnson’s reluctance to seek the extension was manifested by his decision to send three letters to Brussels late on Saturday night, including an unsigned letter to Donald Tusk, European Council President. Mr. Tusk said he was now consulting EU member states on the terms of any extension. Some MPs who backed the Letwin amendment delaying approval, including Oliver Letwin himself, say they will back Mr Johnson’s deal now that they are reassured that there is no risk that Britain could accidentally leave the EU without a deal.

Meanwhile, China’s economy grew 6% in the third quarter, landing right on the central government’s full-year baseline target for gross domestic product, as business activity continues to deteriorate in the world’s second largest economy.

Growth across the board cooled in the third quarter, despite some recoveries in industrial production and retail sales at the end of the quarter, according to data published Friday by the National Bureau of Statistics.

On the other hand, investment in fixed assets, a measure of construction activity that has long been a major economic driver but is becoming less so, was weaker in the first nine months, with a 5.4% rise from a year earlier. That compared with a 5.5% pace in the first eight months and was down from 5.8% growth announced after the first half.

Despite the stronger September figures, downward economic pressure is building. Hence, monetary policy to be loosened before long in response, but it will take time for this to put a floor beneath economic growth.

Our Picks

AUD/USD – Slightly bearish.

This pair may drop towards 0.6805 as China’s growth outlook may continue to weigh on Aussie.

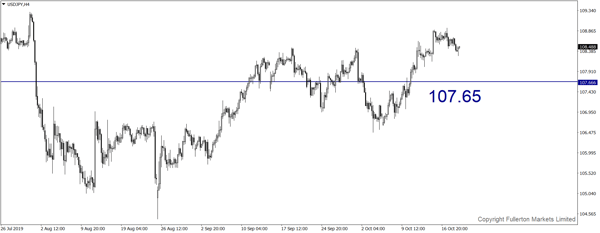

USD/JPY – Slightly bearish.

This pair may drop towards 107.65 amid hard Brexit risk.

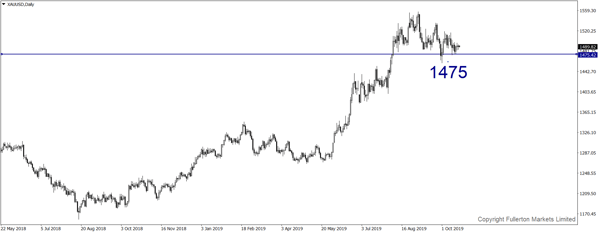

XAU/USD (Gold) – Slightly bearish.

We expect price to fall towards 1475 this week.

U30USD (Dow) – Slightly bullish.

Index may rise towards 26986 this week.

.png?width=600&name=WMR%2020191021%20-%20U30USD%20(Dow).png)

Fullerton Markets Research Team

Your Committed Trading Partner