When trading the Forex market, it’s important to understand currency correlations. This is due to the fact that currencies are traded in pairs. Therefore, no currency is independent in relation to other currencies. Once you have a better understanding of currency correlations, you can maximise your gains by pairing the strongest currency with the weakest currency during your trades.

Forex/Currency Correlations

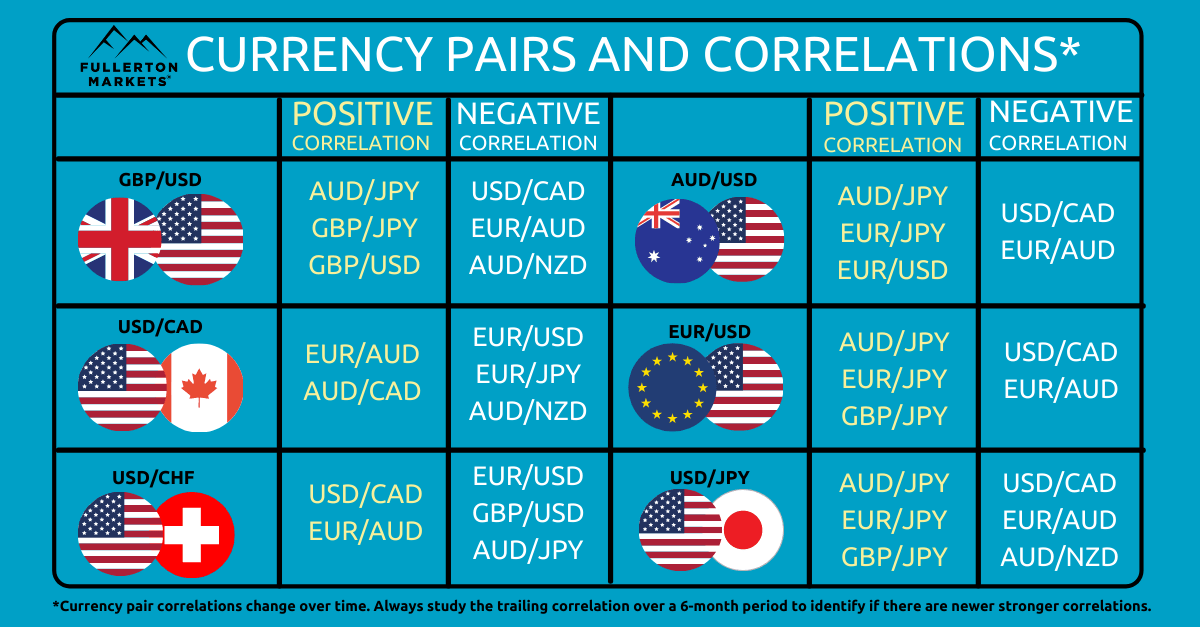

So, what are Forex correlations? If two currencies strengthen at the same time due to whatsoever factors, they are positively correlated. On the other hand, if one currency strengthens while the other weakens, they are negatively correlated.

It's important that traders understand currency correlations when trading Forex because it has a direct impact on the outcomes of their trades. More often than not, a trader is not even aware that this is happening.

Here’s a tool you can use to determine currency strength.

Currencies are grouped into two categories:

1. Risk-on Currencies

2. Risk-off Currencies

Before we reveal which currencies belong to which group, we must first understand what is risk-on and risk-off. Risk-on/off are depictions of market sentiment.

Risk-on Sentiment: When the risk appetite of investors increases, investors start to buy into riskier assets and sell off less risky assets due to optimism. This can be seen as a flow of funds from less risky assets into riskier assets.

Risk-off Sentiment: When the risk appetite of investors falters, they start to sell off riskier assets and go into safe havens. Funds start to flow from riskier assets into less risky assets.

While the market switches between different risk sentiments, the Forex world also has its riskier currencies and safe havens (less risky currencies). Risk sentiments can shift due to political reasons, natural disasters, changes in interest rates, etc. (quite simply, any event that leads to a change in market sentiment).

Risk-on Currencies

1. Australian Dollar (AUD)

2. New Zealand Dollar (NZD)

3. Canadian Dollar (CAD)

Risk-off Currencies

1. US Dollar (USD)

2. Japanese Yen (JPY)

3. Gold (XAU)

You might be asking why gold is included when it’s not a currency. In the Forex world, gold is one of the most traded pairs, as we’ll explain later.

But first, why are risk-on currencies AUD, NZD and CAD also known as commodity currencies? This is because all these countries are among the largest exporters of commodities. When the market is optimistic about the future of the economy, they believe that more consumption will occur, which will require more natural resources for production. This will lead to export-oriented countries equipped with these natural resources to flourish.

A quick look at the commodities exported by these countries:

AUD: Australia is the world’s largest producer of iron ore, coal and the third-largest producer of gold.

NZD: Agriculture is New Zealand’s largest industry. The country is also one of the world’s largest dairy producers.

CAD: Canada is one of the world’s top ten oil-producing nations and they export most of its oil.

Here’s a look at why the USD, Yen and gold fall under ‘risk-off currencies’:

USD: The US treasury bill is the most trusted and acquired in the world. The US Dollar also remains the international currency used in almost all international trades.

Yen: In terms of net foreign asset, Japan holds a positive position. It’s a common belief that the country will sell foreign assets when a crisis hits as a defensive move and repatriate their capital from abroad. This process of converting that capital back into yen would raise its price. Moreover, the Japanese yen has zero to negative interest rates, making it common to borrow in.

Gold: Gold as a physical commodity cannot be printed like fiat money (government-issued currency whose value isn’t underpinned by any commodity/physical good) and gold’s value is not affected by changes in interest rates. Historically, gold has maintained its value over time and has served as a form of insurance for investors in times of crisis.

When the market is pessimistic about the future of the economy, investors believe that people will start to save more and consume less. This causes export-oriented countries to suffer and result in funds flowing out of riskier currencies into safe havens.

Discover insider tips on how to trade and profit more from gold.

How to leverage risk-on and risk-off currencies to maximise profits and minimise losses?

Firstly, once you’ve identified the current market sentiment, you can start to pair the strongest currency with the weakest currency.

For example, when the COVID-19 pandemic first hit in early 2020, market sentiment soured. This would be a good time to short (sell) currency pairs such as NZD/JPY. We can also do the opposite, which is to long (buy) currency pairs such as USD/CAD or gold.

Later, as the market started to recover with the rollout of the vaccines, we started to buy commodity currencies such as AUD and pair them with a safe-haven currency such as JPY (i.e. long AUD/JPY).

Some people will then ask, “What if I trade USD/JPY, the second-highest traded currency pair behind EUR/USD? What do I do when market sentiment changes?” In this case, the correlation might not be valid as other factors such as changes in interest rates or stock market movements will have a higher correlation.

For a more in-depth look at currency correlations, read 17 Proven Currency Trading Strategies: How to Profit in the Forex Market by Mario Singh, Fullerton Markets’ CEO and global finance thought leader.

Forex/Currency Dependence

What is currency dependence, and what are the factors that cause a currency to move?

AUD: China imports large quantities of commodities from Australia. These include coal, gas, iron ore, and wool. For this reason alone, the economies of both Australia and China tend to move in tandem. So, when China reports good GDP numbers, AUD tends to rise. Similarly, when tensions occur (for example, when the US-China trade war intensified in 2018-2019), the Australian dollar will take a hit.

NZD: Dairy product exports are the major revenue earner for New Zealand. An increase or decrease in the price of dairy products can have an impact on NZD. So when prices for milk products increase, there's a higher demand for NZD as well. This results in a high positive correlation between the NZD/USD currency pair and the Global Dairy Trade (GDT) Price Index.

CAD: Canada’s largest export is oil. Therefore, oil prices affect CAD directly. In 2020, as the pandemic raged on, oil prices turned negative as demand for oil dried up. During the same period, the Canadian Dollar came crashing down as oil exports slowed. Find out how oil prices took a negative turn here.

USD: The US Dollar has a psychological inverse relationship with gold. This is because when the dollar falls, the value of other countries’ currencies increases, driving up the demand for and prices of commodities such as gold. Furthermore, when the USD’s value starts to weaken, gold becomes a safer investment option to store value. This is why gold is often considered a safe-haven investment.

Understanding currency correlations and dependence allows a trader to maximise profits by pairing the strongest currency with the weakest currency during shifts in risk sentiment. Similarly, it can also help to minimise losses by ensuring that you do not over-leverage in trades that have positive correlations.

For example, if you were to buy/long AUD/USD, we would not recommend that you do the same with NZD/USD. If the market were to move against AUD/USD, there’s a high chance that your NZD/USD will also weaken.

Ready to grow your wealth from the world's largest financial market and become the next top female trader? No better place to start than right here with us! Begin trading with Fullerton Markets today by opening an account:

You might be interested in: Want to Be More Efficient and Profitable Trading Forex? Trade like a Woman