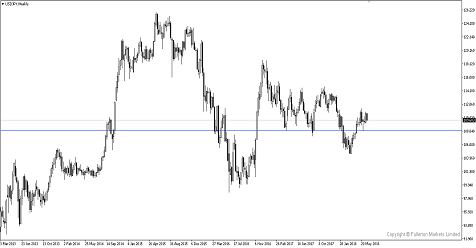

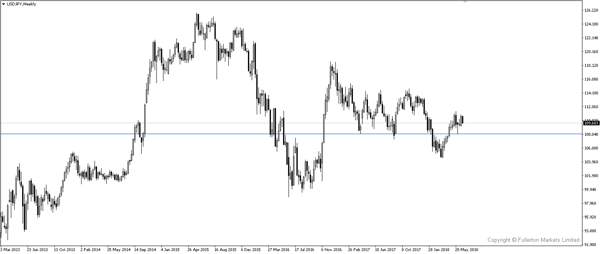

As the trade war is running fast and hot between the US and China, short USD/JPY?

China vowed to retaliate against US companies after US President Trump threatened to place tariffs on another $200 billion in Chinese imports, deepening the trade dispute between the world’s two biggest economies.

- Yen and treasuries rallied after Trump threatened to impose more tariffs on Chinese goods which drew a stinging rebuttal from Asian nations, escalating trade tensions between the world’s two largest economies.

- Every asset class is affected now by the US-China trade war and the lack of volume helps those investors who put their bets on falling markets.

- Shanghai Composite Index slid almost 5% after China said it would take “strong” countermeasures if new levies are issued.

- The latest threat from Trump comes before the first wave of 25 percent import levies which will take effect on 6 July. The tariffs target the “Made in China 2025 plan” that seeks to develop sophisticated manufacturing capabilities.

- Investors are worried US may impose further restrictions on Chinese tech and Internet products and cause greater uncertainty for the global economy

Fullerton Markets Research Team

Your Committed Trading Partner