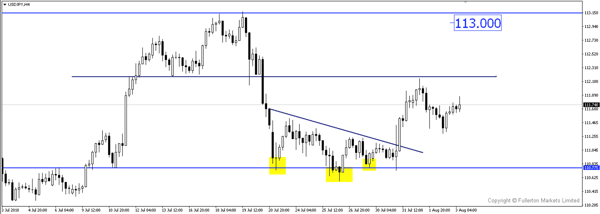

If the unemployment rate dropped to 3.9%, long USD/JPY?

The likelihood of a tighter labour market shown in the labour report later will help to support a firmer income and spending trend.

- On Wednesday, ADP employment data for July surged past expectations, foreshadowing a stronger-than-projected advance in the monthly jobs report this Friday.

- It is possible for the strong pace in job gains to continue which suggest that wage pressures could further intensify. This would push inflation out of its holding pattern and past Fed’s 2% target.

- For now, quarterly earnings and latest manufacturing ISM survey results suggest that the trade-war headwinds are having limited impact on the overall economic activity, indicating that it has limited impact on the labour market as well.

- The underlying acceleration in economic activity amid an environment of limited labour cost pressures will feed into a continued gradual pickup in hiring.

- We expect unemployment rate to lower to 3.9%, and this could be positive to dollar.

Fullerton Markets Research Team

Your Committed Trading Partner