USD/JPY gave up the gains from last Friday. Is the USD/JPY going to head south?

US wage growth slowed, suggesting that a more hawkish Fed may not arrive any time soon

Last week, we were worrying about a potential trade war and US wage inflation. The outcomes of all the data were perhaps the best we could have hoped for. Global stocks market could extend their stabilisation in the next few days.

US Payrolls rose 313,000 in February, compared to the earlier 205,000 median estimates, and the two prior months were revised higher by 54,000, according to Labour Department figures showed on Friday. The unemployment rate held at 4.1% for the fifth straight months. Average hourly earnings increased 2.6% from a year earlier following a downwardly revised of 2.8% gain. Unemployment rate failed to drop towards 4.0% and slower wage growth suggests inflation growth may still be at the pace as previous months, easing those worries on faster-than-expected Fed’s rate normalisation.

We need to pay attention to the rising labour-force participation which may be a factor holding down wage gains. The participation rate increased to 63%, the highest since September, from 62.7% from the prior month. The 0.3 ppt increase in the labour participation rate is the biggest jump since 2010. This suggests the economy still has room to attract more discouraged workers back to the labour market. This factor could lead to Fed having a second thought whether fastening the pace of tightening is appropriate at this moment.

As for the dollar, its recent negative correlation with stocks suggests that it may not move as strong post the report, as the report eased the fears in the stocks market. However, we don’t think dollar’s downside is limited as well due to the steepening yield curve. If the employment data suggested that slack remains in the labour market, why are yields popping a little? Regardless of unemployment rate or wages, 313k in NFP is a big number. Last month, stronger wages left the bond market firmly in the control of overall market direction. With today's report favouring more of a Goldilocks environment, perhaps this time round the stock market will take the lead. Since stronger job growth and weaker-than-expected wages is positive for equities, the end result should be similar: bond yields can hold up.

Judging from the volatility complex, talk of a trade war is no longer the dominating driver. Though unlikely the end of the story, we can still look forward to a moment of calm over the next few days, least until the CPI report this week.

Our Picks

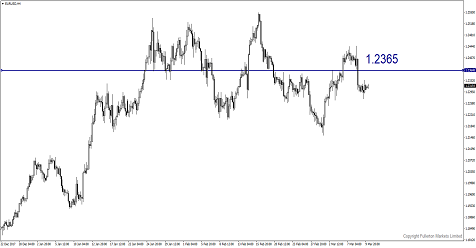

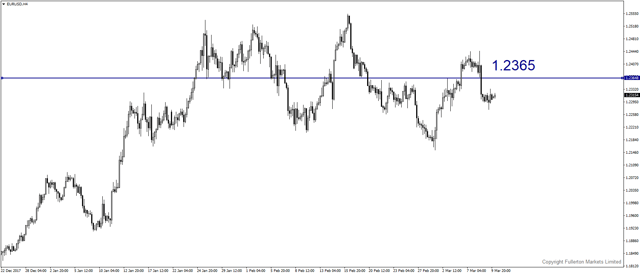

EUR/USD – Slightly bullish.

Stocks rally in Asia session likely to extend to the European session, which may give support to the EUR/USD. We expect the price to move towards 1.2365 in coming days.

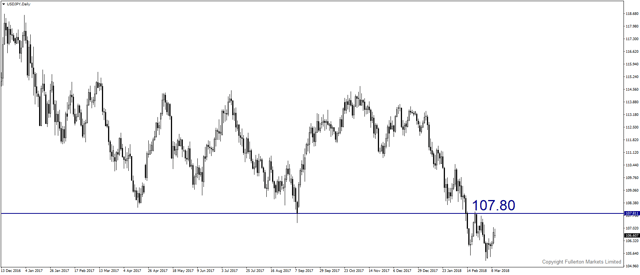

USD/JPY – Slightly bullish.

Despite a soft dollar outlook, recover in stocks market may drive this pair slightly higher. USD/JPY could rise towards 107.80 this week.

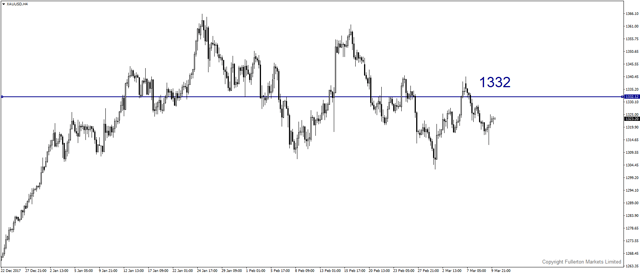

XAU/USD (Gold) – Slightly bullish.

We expect price to rise towards 1332 this week.

Fullerton Markets Research Team

Your Committed Trading Partner