How safe is my investment with Forex brokers?

It depends on the broker you trade with. Not all brokerage firms are made the same way and some might have more or fewer security features in place.

Considering that the Forex market trades $6.6 trillion a day according to the Bank for International Settlements, it’s not without its share of corporate scandals and criminal activities.

This raises the importance of choosing a broker that puts your fund's safety as top priority. You want to trade with a company you can trust to not just secure your capital and profit but pay them back even when the brokerage itself has collapsed.

In this article, we'll look into the fund safety features some brokers offer clients and how Fullerton Markets' fund protection stacks up against other guarantees.

What basic fund protection clauses to look for

Where investments are concerned, due diligence is your best weapon. Take time to study and analyse every Forex broker you come across and review their offers and guarantees.

When it comes to your fund’s safety, you should find answers to the following questions:

- Do they segregate client funds from company funds?

- If segregation is done, are the funds maintained by reputable banks?

- Does the broker provide negative balance protection?

- Are there standardised risk warnings or disclaimers regarding the risks in Forex trading?

- How many security layers are implemented to protect your funds and every related transaction?

- How easy is it to access and withdraw your funds?

Top 4 fund safety features

Some of the answers you’re looking for lies in four vital elements a broker must set in place:

1. Segregated Accounts

In Forex trading, a segregated account is an important term because it indicates that your funds as a client are kept separate from your broker's core banking account. It also means the brokerage foregoes the rights to use the trading capital of their clients for any other purpose except to satisfy margin and trading requirements.

Why does this matter?

Let's look back at one of the most catastrophic events in Forex trading history.

On 15 January 2015, the Swiss National Bank manipulated the exchange rate of the Swiss Franc (CHF) and unpegged it against the Euro (EUR). This resulted in capitulation with the CHF pairs due to the panic that ensued in the market.

The impact across market participants was massive. While large banks and market makers managed to absorb the losses, some brokerage houses collapsed. They resorted to using their clients' deposits as collateral to secure liquidity, which resulted in negative balances. They lost the financial capacity to cover client liabilities and only managed to return pennies to them.

If client equities have been fully segregated, their funds would have remained intact even when a brokerage becomes insolvent.

Now, do you see why segregated accounts are crucial?

They also come with several benefits.

- Provide customers with the assurance that if anything happens to a broker, their money remains safe

- Create a certain level of security and eliminate confusion

- Prevent any opportunity for pilferage from employees or company directors

- Help automate bank transfers both inbound and outbound

- Give customers more control over their money

- Ensure easy access and withdrawal of funds

- Protect the brokerage from unnecessary risks

Most importantly, segregated accounts improve transparency and help a company better mitigate liquidity risk. A client can withdraw a substantial amount without affecting the brokerage.

2. Custodian Agreement

Another way that brokers could have prevented a collapse from the 2015 event is by opening a custodial account. This is essentially an escrow account that is established under a client's name and administered by a financial institution that acts as the custodian.

It holds assets and securities on behalf of the clients, as well as credits or debits the account for losses or profits within 24 hours of the end of the trading day.

If you trade with a broker who has an agreement with a custodian, your funds are protected against the risk of insolvency.

Moreover...

- Your account is protected against unforeseen events and any management strategy fails a broker makes

- You'll receive clear and concise information regarding your equity and not a jumbled report of brokerage funds

3. Insurance

Different brokers offer clients different insurance coverage. Some cover individual investments to a certain amount, while others ensure clients from unsavoury risks taken by company staff and/or the account custodians. These risks include negligence, omissions, and fraud.

Fullerton Markets' insurance policy provides unparalleled fund safety as it's taken on the custodian to protect clients from wrongful or criminal acts perpetrated by the custodians and from cybercrimes.

Learn more about Fullerton Markets' contribution to the transformation of the Forex market.

4. Negative Balance Protection

When you lose more money than you have in your account, you're basically looking at a negative balance. Your broker will require you to deposit more into your account or they'll do any means necessary to collect what you owe them.

Negative balance protection ensures your broker can handle such a situation when it arises.

Say your capital is $1,000 and you traded with a 5:1 leverage, giving you a position of $5,000. If the price drops 7% due to market turbulence, you're looking at a loss of 35% or $1,750. This means you lose your capital and owe your broker $750.

If negative balance protection is in place, you won’t lose more than your capital or the amount deposited. This is because each time your account balance becomes negative, it will be automatically adjusted to zero.

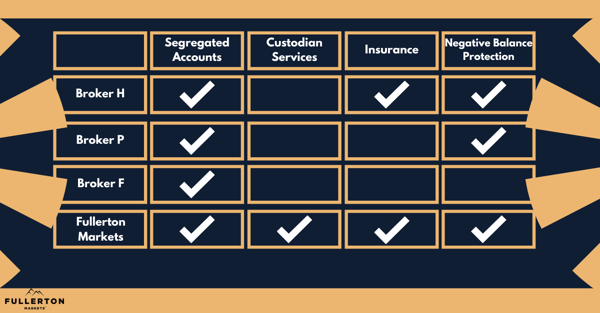

By looking into segregated accounts, custodian services, insurance, and negative balance protection, you can ensure that you're trading with a broker fully capable of protecting your account.

Not all brokers offer all four features, however.

Introducing Fullerton Markets’ Fullerton Shield

Fullerton Shield is a triple-level protection plan that encompasses segregated accounts, custodian agreement and insurance policy.

You're assured that your funds will never be used for operating expenses as they're kept separate from corporate funds.

The Fullerton Custodian (FC) is responsible for your funds and operates under a Custodian Agreement. It has its own set of directors and is not controlled by the directors of Fullerton Markets.

As for the insurance policy, your account is covered by Professional Indemnity Insurance and Crime Cover. The former is taken on the custodian to cover legal costs and expenses incurred if it's alleged to have underperformed, resulting in you suffering from a financial loss. The crime cover, on the other hand, protects the custodian against fraudulent acts and events committed by employees or third parties.

The negative balance protection is another safety feature that makes up the Fullerton Edge. It allows you to remove any negative balance in your trading account.

Watch this video for more information on Fullerton Market's triple-secured Forex fund safety.

Fund Safety Comparison

How does Fullerton Edge stack up against the fund safety features of the top three Forex brokers?

Bottomline

This is your money we're talking about. It's only natural that you'd want it protected against any risks when investing and trading in the foreign exchange market.

With a broker that provides you with unparalleled fund safety, you can trade, earn and grow your business with peace of mind, not with anxiety over your trading capital constantly hovering over your head.

So make sure you perform your due diligence before you choose a broker to partner with.

Ready to grow your wealth without the worries in the world's largest financial market? No better place to start than right here with us! Start to trade, earn, and grow your wealth today with guaranteed unparalleled fund safety with Fullerton Markets by opening an account:

You might be interested in: Top 3 Features of the Best Copy Trading Platform for You