Weaker Canadian inflation and retail sales will not deter BoC from raising rates, long CAD/JPY?

Bank of Canada (BoC) is widely expected to raise interest rates during their rate statement tomorrow.

- Canada’s annual inflation rate in September dipped to 2.2 percent from 2.8 percent the previous month. However, this marks the eighth consecutive month that the inflation rate is above Bank of Canada’s target of 2.0 percent

- Similarly, retail sales fell by 0.1 percent in August, the second drop in three months. Data showed that retail sales dipped to $50.8 billion due to lower sales of gas and clothing.

- The fall in the inflation rate was expected as Canada’s central bank has predicted inflation to move back down towards 2 percent by early 2019.

- Market expectations of a hike tomorrow came in at 96.95 percent as reflected in the overnight index swaps market.

- We feel that the overall weakness in Canada’s economic data released last Friday should not alter BoC’s move to raise rates tomorrow as the US-Mexico-Canada Agreement has removed a key risk for Canada’s economy.

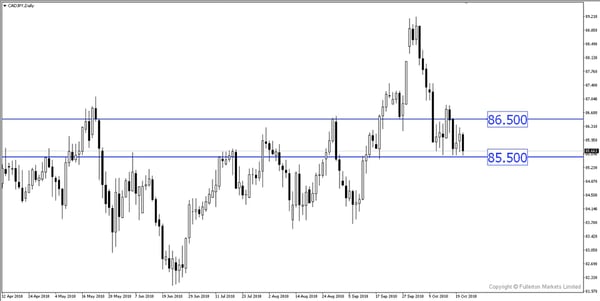

- CAD/JPY has been moving lower for the past few weeks and is now sitting on a major support at 85.50 price level. We believe that the announcement of the rate hike could bring this pair back to the 86.50 price level which is the next immediate resistance.

Fullerton Markets Research Team

Your Committed Trading Partner