Editor's Note: This article was published on August 26, 2020, and was updated for accuracy.

Who doesn't want to receive a bonus?

You have to appreciate how wonderful it is to receive extra rewards on top of regular pay or income. If you don't have to do much to earn that added bonus, the sweeter the deal.

The same is true in Forex.

Most Forex brokers offer bonus programs to attract more traders and to help them build a relationship based purely on mutual rewards.

Different bonus programs, however, follow different structures that will influence the actual reward you receive and how you can use it.

This is why you should make an effort to study each bonus program before you sign up with a specific broker.

In this article, we’ll focus on the bonus you’ll receive upon making a deposit.

What is a Forex deposit bonus and how does it work?

A deposit bonus is compensation given to a trader for signing up for a particular broker. The bonus can range from 10% to 100% of the deposited amount plus a few extra incentives, depending on the broker. Some programs may also reward traders with a one-time welcome bonus (anywhere from $20) when they sign up and make a minimum deposit.

To receive a bonus, you must first fund your account. How soon you receive the bonus may take a few hours or days, something you also need to consider. This is especially true if you're eager to start trading.

Now, deposit bonuses may come with some caveats.

All deposit bonus programs require you to make a minimum deposit before you'll receive your reward. Some brokers offer a straightforward arrangement of a minimum $100 deposit, while others will require you to meet certain conditions to earn your deposit bonus.

If it says “plus a trading bonus,” then you'll have to complete a certain number of trades before you receive your deposit bonus. In some cases, you only need to complete one trade before rebates are credited to your account.

Also, the bonus you receive may only be given upon the initial deposit, nothing else on your next one. Some programs, however, offer bonuses every time you make a deposit, such as Fullerton Markets’ Infinity Exclusive Bonus.

As you can see, a bit of attention to detail will go a long way in choosing the best deposit bonus program.

What are the benefits of deposit bonus programs?

Some Forex brokers offer a no-deposit bonus, where you don't need to make a deposit to receive a tradable bonus. While this may sound like a great deal, you're not getting as many benefits as when you do fund your account to receive extra rewards.

1. Bigger trading capital/equity

Let's say you fund your account with USD1,000 and the bonus is at 30% upon deposit. So that's an additional USD300. This means your overall equity is now USD1,300.

You can then trade this amount without the increased risk. After all, the extra USD300 is your bonus. If you happen to make a winning trade, then you earn more profit from the money you deposited.

If you increase the amount of your initial deposit, you can also hold more positions and trade bigger lot sizes.

Suffice to say that a better deposit bonus program gives you more options to play with the foreign exchange market and increase your chances of earning more.

2. Increased leverage

With more capital in your account, the better position size you can trade. This increases the likelihood of earning bigger profits. Who doesn't want that?

Because part of the equity you trade is your bonus, you can leverage your position at a greater advantage than if you're only using your own funds. This eliminates a bit of the risk that usually comes with increased leverage.

3. Lower initial investment

Fullerton Markets, for example, only requires a minimum deposit of USD100 for you to earn a bonus starting at 30%. If you can afford to and want to open more positions, increase your deposit to USD1,000 or more.

With a bonus that doubles up as extra trading capital, you can surely trade different position sizes to increase the possibilities of you making more profit.

4. Enable thorough testing of a trading platform's performance

If you simply want to check out a trading platform's performance, the minimum deposit combined with the deposit bonus will give you enough funds to explore.

Use what capital you have to check out how fast a platform executes a trade to prevent slippage. Or, find out if a broker allows a requote or not.

Learn more about Fullerton Markets' lightning-speed execution and other trader-friendly features.

The same funds will also provide you with the opportunity to hone your trading skills or test the outcome of a specific strategy that you want to execute.

5. Verify how a broker takes care of its traders

As previously mentioned, you need to be meticulous about the terms and conditions that come with a bonus program. Because some of them remove any of the bonuses you earned with any withdrawal made. Others, on the other hand, will only allow you to withdraw the bonus after you’ve reached a certain trading volume.

You're better off with a broker that offers proportional removal of your bonus when you withdraw from your account. For example, if you withdraw 60% from your available balance, 60% is also removed from your bonus. This deal is much better than if you were to lose your entire bonus.

Understanding the link between your deposit, bonus and trading capital

Simply put, the bigger the deposit you make, the bigger your trading capital.

For example, if you deposit USD500 and a 50% trading bonus is applied, the bonus received is USD 250. Added to your trading capital, the total now becomes USD750. You can then use the amount to open trades and choose better position sizes.

If you crank up the amount to USD10,000, then your capital increases to USD15,000 when the same 50% bonus is applied.

So even when the broker you choose only requires a minimum deposit, you have more advantage if you fund your account with a bigger amount.

How can a deposit bonus guide you in your choice of a Forex broker?

Different brokers offer different bonus programs in Forex, which is why the bonus offered can influence the choice of broker you sign up with.

For maximum returns, choose a broker that:

Offers a bonus program that fits your trading goals. For instance, if you wish to trade with more capital but lower risk, choose a broker with a higher bonus structure but an affordable minimum deposit required.

Sets little to no limitations. You get to trade your bonus and don't lose it upon withdrawal or when your trades result in more loss than your initial deposit.

Presents terms and conditions clearly. You want all the rules that govern the bonus program laid out to you to avoid confusion. If a broker tries to hide any terms, consider this a red flag.

Considerations before applying for a deposit bonus

Careful consideration is the name of the game here to avoid being on the losing end. Therefore...

Read the Forex deposit bonus terms and conditions carefully.

- Will your bonus be removed in the event that you make any form of withdrawal?

- Can your bonus be transferred?

- What happens if you lose more than your initial deposit?

Make sure that you fully understand what is required.

- Do you need to make a deposit to earn a bonus?

- Do you have to wait until your account has been verified before your bonus is credited to your account?

- When will you receive your bonus? Right after a deposit is made or after one completed trade?

Run a comparison between two to three bonus programs to get the best offer.

Because the associated terms and conditions of an attractive bonus structure might not always be that favourable to you.

When in doubt, speak to an account manager or contact a broker's customer service department.

Deposit Bonuses Offered by Fullerton Markets

Fullerton Markets' Infinity Exclusive Bonus is the first and only infinity bonus in the market. You get to enjoy unlimited losable credit bonuses, regardless of the amount you deposit.

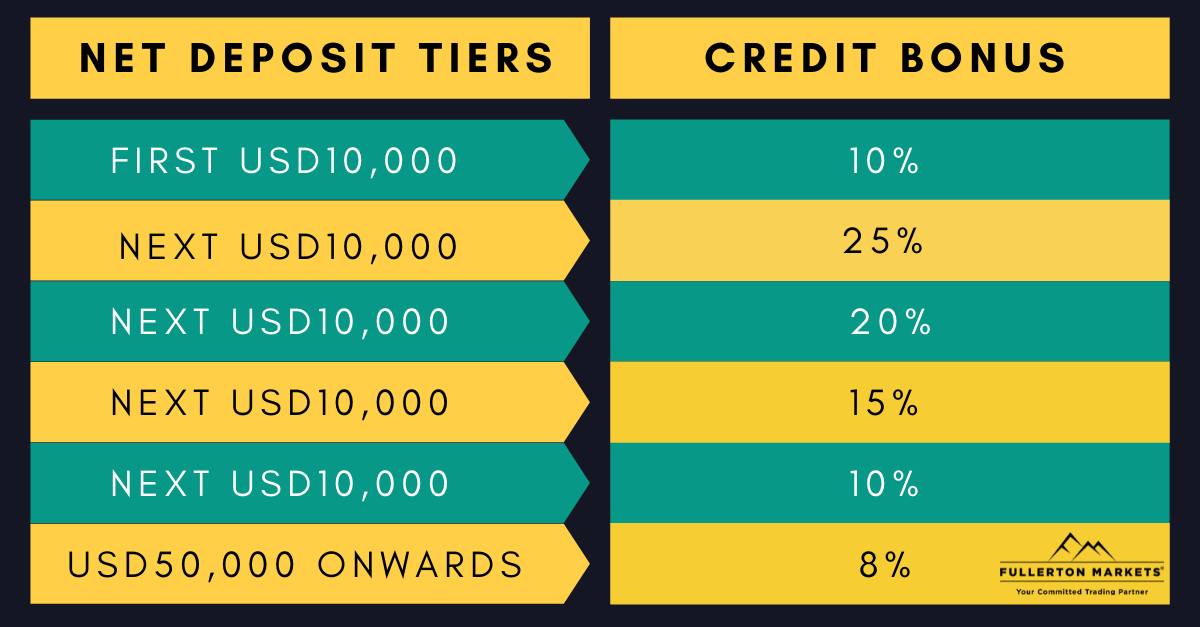

It comes in six levels with different bonus rates. Your first deposit of USD10,000 will earn a 10% bonus, while the sixth deposit earns 8%. When summed up, you get a significant amount of deposit bonus.

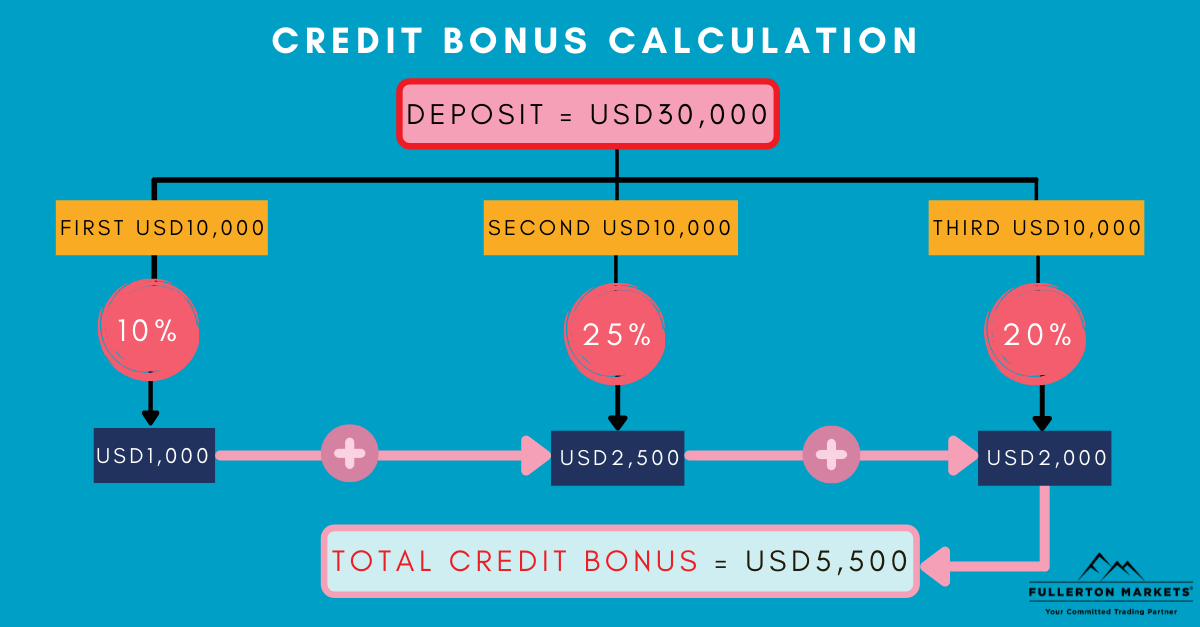

For example, with a deposit of USD30,000, you’ll be able to collect a bonus of USD5,500 in total.

This is based on the calculation: [(10% x USD10,000) + {25% x USD10,000) + (20% x USD10,000)]. Below is a visual presentation of how the said bonus is calculated.

Most importantly, only a proportional amount of your bonus is removed upon withdrawal.

Ready to grow your wealth in the world's largest financial market and enjoy unlimited bonuses at the same time? No better place to start than right here with us! Begin trading with Fullerton Markets today by opening an account:

You might be interested in: How Can You Benefit as a Strategy Follower on CopyPip