US bond yields inverted for first time since 2007, sell USD/JPY?

Weak economic data last Friday drove the yield on 10-year Treasury notes below that of three-month bills for the first time since 2007

Fresh data suggesting the global slowdown may be intensifying, caused a widely watched bond-market indicator to flash its first recession warning since 2007 on Friday. This raised expectations that the Federal Reserve may cut interest rates by year end to counter the economic headwinds.

The latest signs of trouble came last Friday when a report showed factory output in the eurozone fell in March at the fastest pace in six years, while the US manufacturing activity slid to its lowest level in almost two years. These data followed a Thursday report showing US service-sector revenues slowed more than previously thought in the fourth quarter, prompting several economists to lower their growth estimates.

The developments represent a stark turnaround from December, when Fed officials raised rates amid strong growth, tight labour markets and steady inflation. Since then, the picture has been muddied by choppy US economic data, record-length government shutdown, global trade tensions and UK’s unresolved Brexit plan.

The weak economic data last Friday drove the yield on 10-year Treasury notes below that of three-month bills for the first time since 2007. This situation, known as an “inverted” yield curve, has preceded every US recession since 1975 and is viewed by many investors as a reliable predictor of downturns.

By the end of last Friday, traders in futures market had put a 58% chance of at least one Fed rate cut by the end of this year, up from 11% a month ago. Most analysts still think the economy is on solid footing, as does the Fed. On Wednesday, policy makers at the central bank projected US gross domestic product would expand 2.1% this year and 1.9% in 2020, down from 3.1% last year, but slightly faster than its long-term potential.

Fed’s Powell said at the press conference on Wednesday that the Fed has a positive outlook for this year, underpinned by rising wages, low unemployment and high levels of household confidence. But Powell also pointed to a number of risks, such as slowing growth in Europe and China, and uncertainty surrounding US trade policy. While fiscal-stimulus measures shielded the US economy last year from such headwinds, the effects of 2017 tax cuts and 2018 spending increases are fading. In conclusion, Fed didn’t project any rate hike in 2019.

Our Picks

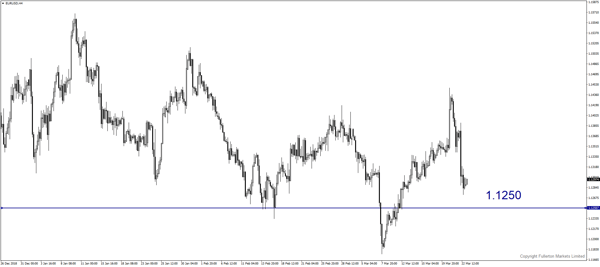

EUR/USD – Slightly bearish.

Subdued economic data released last Friday may push this pair towards 1.1250 this week.

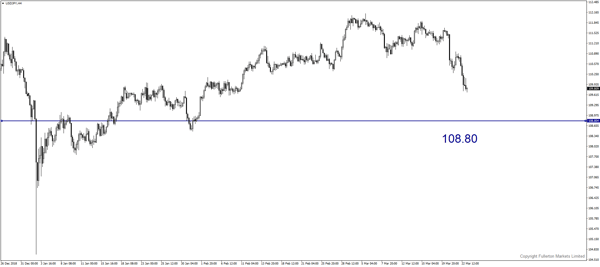

USD/JPY – Slightly bearish.

Funds chasing for haven may pressure this pair towards 108.80 this week.

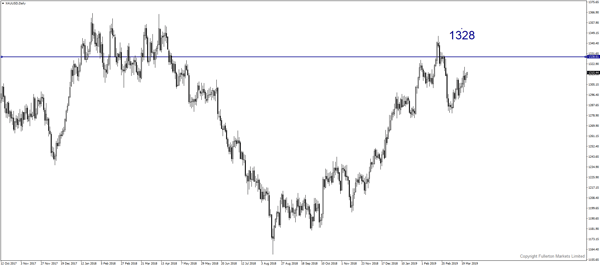

XAU/USD (Gold) – Slightly bullish.

We expect price to rise towards 1328 this week.

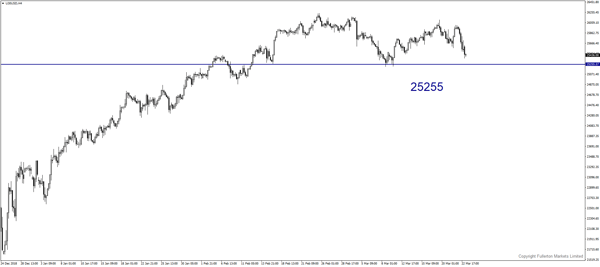

U30USD (Dow) – Slightly bearish.

Index may further lower towards 25,255 after US Treasuries’ yield curve inverted, signalling a possible recession ahead.

Fullerton Markets Research Team

Your Committed Trading Partner