The title may sound ironic but in reality, the fastest way to learn how to make money is actually by losing it.

Please don’t get me wrong, losing money doesn’t necessarily mean you need to empty your trading account. But, you still need to lose in order to learn. When you uncover the reasons behind your losses, you will better understand how the market works and find your edge.

Forex trading is a skill, much like leadership, communication and the list goes on. For this skill to be put to good use (and bring you profit), you would first need to hone it.

“It’s good to learn from your mistakes. It’s better to learn from other people’s mistakes.” – Warren Buffet

It’s no secret that by learning from the mistakes of others – in this case, traders – you can improve your trading experience. Here, I share five guaranteed ways to lose money while trading forex:

1. Not Placing a Stop Loss

Stop loss provides a safety net that ensures traders set the maximum amount of money they can lose on a single trade. I’ve seen many traders entering a trade or trades without setting stop losses. Some believe that trades need to have ample space to ‘breathe’ before moving into profit.

However, with fast-moving news and market reactions, prices can be quick to fluctuate. Without a stop loss in place, you’re bound to burst your account if the trade goes against you in a huge move. Take for example the unexpected turmoil caused by the Swiss National Bank’s decision to abandon the minimum rate of 1.20 Swiss francs against the euro, which it had been defending for three years – during the SNB black swan, the Swiss currency spiked in value immediately, sparking volatility in the currency markets.

If you find yourself looking at your trades every minute, either worrying about hitting the stop loss or widening it when the trade goes against you, then it means you’re risking too much in a trade. Consider limiting your risks to not more than 5% of the capital in your account.

2. Ignoring Forex News

Yes, Forex news can move the market. Another reason why traders lose money is that they’re not updated on the latest news and economic changes. We list essential market news affecting the forex market that traders should take note of here.

For example, you might be inclined to enter a trade upon seeing a bullish flag formation that is about to break out upwards, without first monitoring the news. The central bank of the currency you are buying could suddenly cut its interest rates, even before the trade goes into profit or hits your target price. This decision causes the currency to fall and to go against your trade, causing you to hit your stop loss.

Oftentimes, traders open a trade without checking for short-term economic news. Make a habit of considering both technical and fundamental analyses before opening a trade. Always check for forex news!

3. Losing Control of Your Emotions

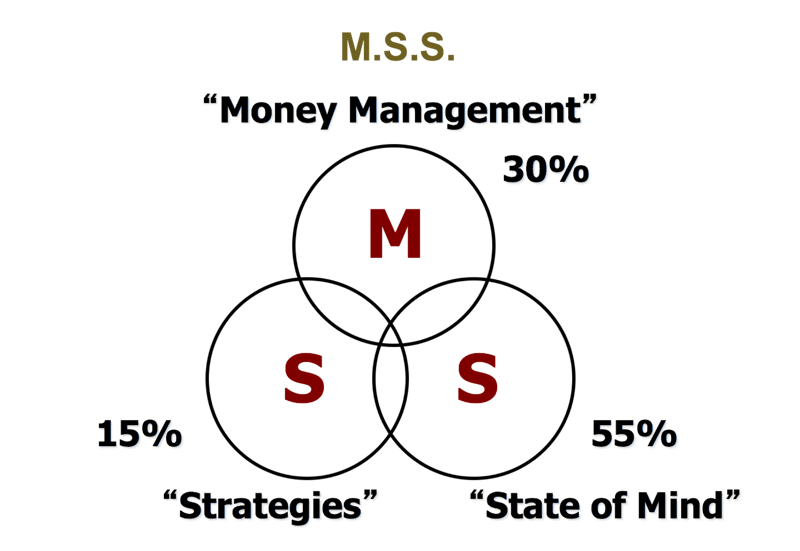

If you follow our CEO Mario Singh’s presentations, you’d be familiar with his law of trading success, otherwise known as the M.S.S:

Law of Trading Success, M.S.S

Here, Mario identifies “State of Mind” as being 55% responsible for trading success. Being in a good state of mind also means controlling your emotions. When one trades emotionally, they may engage in revenge trading, which may involve starting ill-conceived trades once they lose money; removing their stop loss for fear of realising losses; or taking on even bigger trades in hopes of recovering previous losses.

On the other end of the spectrum, traders who get over-excited when they see their trades move may abandon their trading plan and stack up risky trades.

Lastly, traders make the mistake of letting their losses run and cutting short their profit. This is completely normal when you’re not conscious of your emotions. These traders don’t close losing trades, in the belief that they are bound to turn around, ultimately causing them to suffer huge losses.

4. Trading Without a Plan

If you fail to plan, you plan to fail. These words cannot be truer especially in the field of trading. A trading plan is a set of rules that you use to determine whether you should take a trade or not. It should take into account the trader’s personality, personal expectations, risk management rules, and trading strategy/ies. When you follow a trading plan, it can help you to limit trading mistakes and minimise your losses.

Sticking to a plan allows traders to detach themselves from the emotions that arise from opening a trade. If a trade does not meet the requirements of your trading plan, you simply skip the trade. It’s important to note that a trading plan has to be refined along the way as you figure out what works and what doesn’t.

Not having a plan during your trading journey is foolhardy because you’re trading on gut instinct and without a real understanding of what you’re doing. While having a plan doesn’t guarantee immediate success, doing without one may prove to be a major roadblock in your trading journey! Start with a plan and constantly refine it to establish an edge in the market.

5. Over-leveraging

Finally, over-leveraging is the most common way traders can lose their money. Leverage is a double-edged sword as real leverage has the potential to enlarge your profits or losses by the same magnitude. People are attracted to forex trading because they can get leverage accounts, i.e. they can use small amounts of money to make big profits.

Let’s say you have an account which has a leverage of 200:1, and you make a deposit of $1,000. This would mean that you have access to 200,000 units of your chosen currency. It’s easy to see that with just $1,000 and being able to trade with $200,000, your profits can be easily amplified. However, leverage also works in the opposite direction, amplifying your losses by the same magnitude.

Like any other tool out there, if you learn how to use it to your advantage, you can actually maximise your profits and minimise your losses to produce consistent results.

Overall, the forex market is not a scary place. Opportunities abound and there is money to be made. Just be sure to do the exact opposite of the 5 things mentioned above!

Louis Teo

Market Strategist