In the forex market, it is important for traders to know the various economic indicators and market news which move the market. It is vital to understand each piece of data, its implications and how to trade to your advantage.

Technical Analysis can be profitable but one must always bear in mind fundamentals play a big role in driving the market. We have listed the top 5 News Releases/Economic Indicators you must know in order to master the game of Forex.

1. Central Bank Rate Decision

The Central Banks of each country meet on a regular basis to decide the interest rates. The decision they have to make is whether to raise, lower or maintain the current rates. The outcome is of great importance as it affects the sentiments of the market as to how the economy is doing and going to do in the future. For traders, it influences your decision to buy or sell or stay out.

An increase in rates is generally seen as bullish for the currency (meaning it will increase in value) and a decrease in rates is generally bearish for the currency (meaning it will decrease in value). An unchanged decision can be either bullish or bearish depending on the market expectations at the time.

Although the actual rates are important, the policy statement that comes together may also give a good guidance as to whether the Central Bank is hawkish, dovish or neutral. In general, if the Central Bank is more hawkish, it is bullish for the currency, and if the Central Bank is more dovish, it is bearish for the currency. This is also where monetary policy is announced, which concerns vital matters such as the implementation of QE (Qualitative Easing), shrinking of balance sheet etc.

Example: The FOMC on 14th of June 2017 caused a slight panic when FOMC announced in their meeting on its plan on shrinking the balance sheet. It is the first time in recent FOMC meetings whereby a reduction in reinvestment of principal payments is announced. The dollar rose as the market expected the US economy to be sustainable and rates normalisation to continue.

Example: On the 2nd of November 2017, Bank of England announced a rate hike of 25bps to 0.5%. The initial reaction was bullish for the Sterling, but the sentiment reversed when the market realised the rate hike could be “once-and-done” and a long wait to the next rate hike.

Bank of England Lifts Rates, Source: Financial Times - November 3, 2017

2. Gross Domestic Product (GDP)

The Gross Domestic Product (GDP) is a monetary measure of the market value of all final goods and services produced in a period of time. Hence, GDP provides a good gauge of the economic health of the country. A country’s central bank has expected growth outlooks each year that determine how fast a country should grow, as measured by GDP.

When GDP falls short of the forecasted value, it is bearish for the currency and when GDP surpasses expectations, it is bullish for the currency. The figures are eagerly observed by forex traders and can be used to carefully anticipate Central Bank decisions.

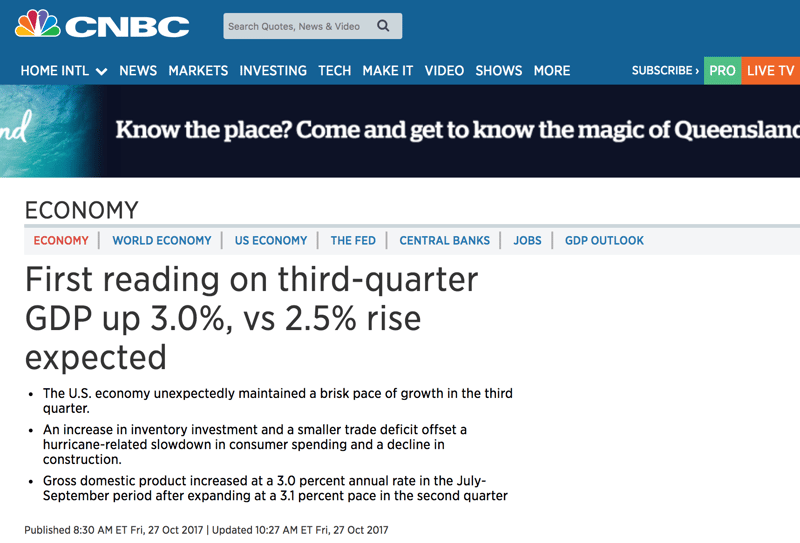

Example: The US economy reported a GDP increase of 3% vs 2.5% forecasted. The stronger than forecasted GDP provided a more than need boost to the Dollar as Fed Chair Janet Yellen cautioned in September of a slow in in economic growth due to the weather distortions caused by the hurricanes.

The US GDP Growth vs. The Forecasted US GDP, Source: CBNC - October 27, 2017

You can read the continuation here.

Louis Teo

Market Strategist