Editor’s Note: This post was originally published on December 16, 2016, and has been updated for accuracy and comprehensiveness.

The Forex market trades $6.6 trillion per day, according to a 2019 triennial survey conducted by the Bank for International Settlements. If that's not enough to make your head spin, choosing a broker from a huge number of brokers that have accumulated over the years will.

There's always the question of reliability, safety and security.

Can you trade foreign currencies without a broker? No.

All individual traders must trade through a broker. This makes choosing a company that you can trust critical to your trading journey in the Forex market.

However, not all brokers are of the same mould. You will need to find a broker that meets your specific needs as a trader. This is where the difficulty lies since not all brokers offer the same services or have the same policies.

In this article, we will discuss the seven rules that every trader must consider when choosing a Forex broker.

1. Execution

One of the considerations you must look into is the speed and reliability of trade execution. It's vital that your broker fills your order at the best price possible.

For example, if you buy EUR/USD for 1.1700, your order should be filled at that price or, if there are differences, just within a pipette of it. This is especially important if Forex scalping is your trading strategy of choice. Quick execution speed is also your weapon against slippage that can make a sizeable dent on your trading capital.

So be sure to check how quickly a trading platform executes your order. You may need to open a demo or live account to test this feature, which will be worth the initial investment in the end. You don't want to lose small amounts, which can quickly add up with every trade due to unreliable execution.

2. Spread and Commission

For every trade, you have to pay a commission to your broker, usually in the form of a spread. This refers to the difference between the ask and bid prices of each currency in a currency pair. The spread is usually calculated by pips.

Different brokers quote different spreads. Some of them:

- May charge according to a specific percentage of the spread

- May charge no commissions but earn money through a wider spread, either a fixed or variable spread that is based on market volatility

- May charge fixed or non-fixed commissions. The former is a flat charge, while the latter depends on the type and size of a transaction.

3. Trading Platform and Software

The best trading platforms come with the following features:

- Easy to use and navigate

- Must be stable and reliable

- Built with visually pleasing graphics

- Equipped with charts, indicators, and other tools for technical and/or fundamental analysis

Most importantly, it should allow for quick and easy trade entry and exit, with clear and prominently placed ‘buy' and ‘sell' buttons.

You may need to open a demo or live account to get a good overview of a platform's functionalities. This is also one way to understand a broker's charges and fees, test the platform's execution speed, and check if the price displayed is honoured upon buying or selling.

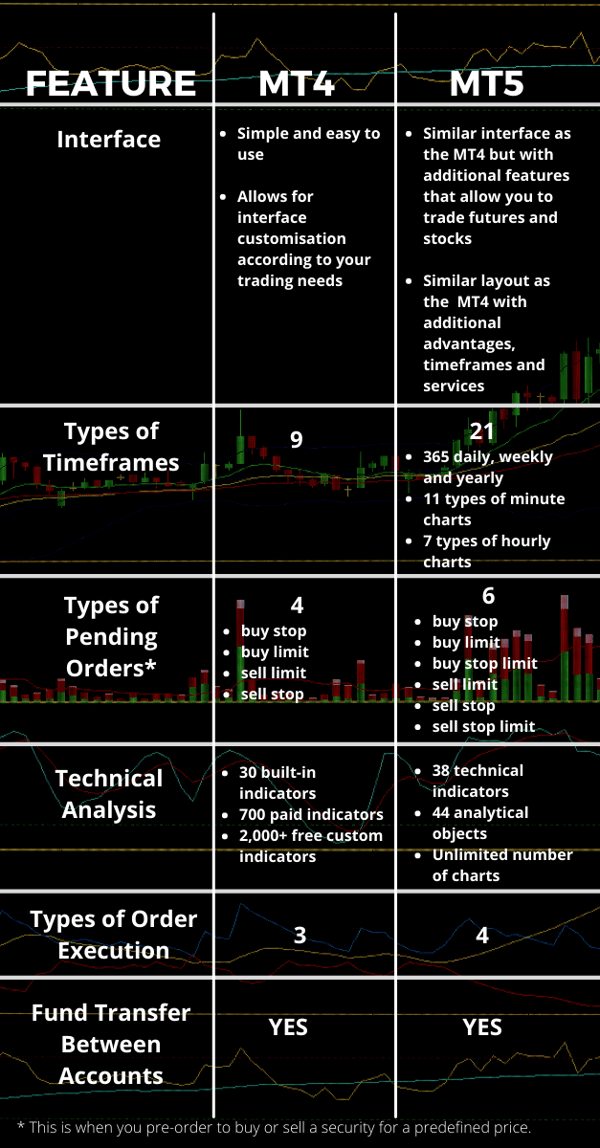

A majority of Forex brokers offer trading on the MetaTrader 4 (MT4) platform, some on MetaTrader 5 (MT5), while others offer Forex trading on both platforms.

What are some of the major differences between the two?

4. Customer Support

Because the Forex market is dynamic and operates 24 hours a day, the broker you choose must provide customer support that runs at the same time. You'll never know when you might hit a snag while trading.

So check out provided avenues of support--direct line, Live Chat, knowledge base, email, etc. The more options you have, the better.

Nothing beats a broker that has a “Live Chat” function with an engaging and responsive customer service officer on standby. If said customer support is offered in several different languages, then you know that the broker is serious about fostering a relationship with traders all over the globe.

5. Minimum Trading Size Requirement

Next on your list to consider is the size of the minimum trading requirement. Most brokers offer two basic account types:

Standard account

- The standard size for a lot is 100,000 units of currency

- 1 pip is usually worth USD10

Mini account

- A lot is 10,000 units of currency

- 1 pip is usually worth USD1

Between the two, the mini account is recommended for beginners in Forex trading. Because of the minimum lot size for this account type, the potential profit and risk per trade are lower.

6. Fund Safety

This is another big concern for retail traders. Almost everyone asks the question: “How safe are my funds?”

In this day and age, it is not enough for brokers to just have segregation between their corporate and client accounts. There are several brokers who offer an additional layer of safety by engaging a custodian to administer the deposit and withdrawal process for their clients. Look for brokers who offer these additional layers to protect trading funds.

Learn more about What the Best Brokers Offer to Ensure Your Fund's Safety

7. Deposit/Withdrawal Procedures

The broker you partner with should allow you to fund your account and withdraw your profit smoothly and quickly. We highly recommend that you run a comparison on the deposit and withdrawal fees of some brokers to see which ones impose lower fees.

Other factors to consider:

Leverage and Margin

Depending on a broker, you can have access to a variety of leverage amounts such as 1:50 or 1:100. Leverage is basically borrowed capital that a broker extends to margin account holders.

If your account size is $1,000 and you use a leverage of 1:100, you're allowed to hold a position with a $100,000 value. If you trade with a winning position, your profit will be enhanced significantly. If the opposite holds true, your losses will be magnified as well.

So use leverage and margin with caution.

Initial deposit

A lower initial deposit makes it easier for new traders with smaller capital to join and trade with sufficient leverage. When the minimum deposit is high, however, this may deter new traders – who don’t have enough capital – from opening an account and trading.

Bonuses and Promotions

There are many types of bonuses that brokers offer such as non-withdrawal bonus, losable bonus, welcome bonus, and deposit bonus. Read reviews and run a comparison between bonuses and promotions to help you choose the right Forex broker.

Here’s What You Need to Know About the Benefits of Forex Bonus Programs

Does Fullerton Markets meet all these criteria?

Fullerton Markets can guarantee lightning-speed execution. It has data centres located in prime locations all around the Asia Pacific region that are connected to ultra-high-speed servers located in London.

Along with its partnerships with tier-one banks and Equinix and world-class infrastructure, clients enjoy continued low latency connectivity. As a result, order execution is more than just reliable. It's lightning fast.

As for spread and commission, we offer two types:

- Variable spreads at no commission charged

- ECN spreads with a flat fee of USD10 per lot commission for Forex instruments

We currently run an MT4 trading platform but are scheduled to launch the MT5 platform. This way, we can provide you with more trading options.

What about fund safety and security? With our triple-level protection plan, Fullerton Shield, you can be sure that your funds are kept separate from the company's account and protected by insurance and a custodian agreement.

Fullerton Markets also offers many funding and withdrawal options and different Forex contract specifications. Other features that clients can tap on include regularly updated educational content in the form of free trade calls, LIVE technical analysis sessions on Facebook, as well as online classes covering a variety of trading topics to help you become a consistently profitable trader.

Ready to grow your wealth in the world's largest financial market? No better place to start than right here with us! Trade, earn, and grow your wealth today with guaranteed unparalleled fund safety with Fullerton Markets by opening an account:

You might be interested in: A Comprehensive Guide on Short-Term vs Long-Term Forex Trading